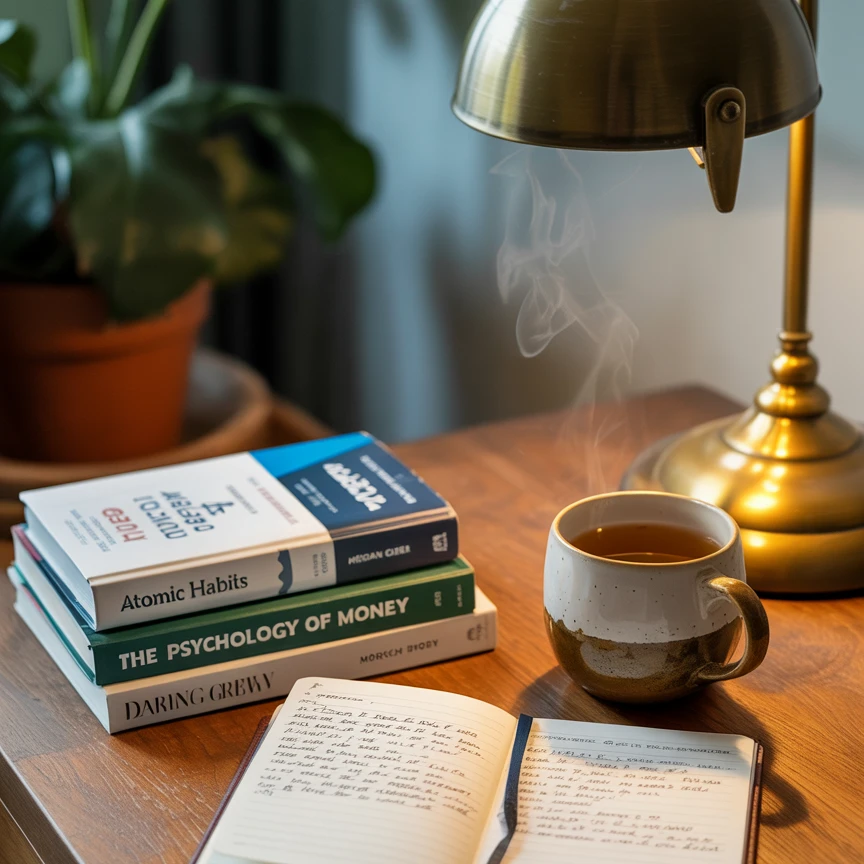

It wasn’t what you’d expect. And it taught me something beautiful about finding peace.

True peace with money isn’t about having more. It’s about having clarity.

“We stopped avoiding money conversations”

Now we actually enjoy our monthly budget meetings ”Roberts helped us turn money from a source of conflict into a tool for teamwork.”

Megan & Luis H.

Married Professionals

“We stopped avoiding money conversations”

Now we actually enjoy our monthly budget meetings ”Roberts helped us turn money from a source of conflict into a tool for teamwork.”

Megan & Luis H.

Married Professionals

“We stopped avoiding money conversations”

Now we actually enjoy our monthly budget meetings ”Roberts helped us turn money from a source of conflict into a tool for teamwork.”

Megan & Luis H.

Married Professionals

Sarah and Tom earned $75,000 combined but felt broke every month. After getting clarity on their spending patterns, they discovered they were wasting $800 monthly on forgotten subscriptions and inefficient systems. Within 60 days, they had their first $1,000 in savings in 5 years.

I’ve made my own financial mistakes. My job isn’t to judge where you’ve been—it’s to help you get where you want to go.

Choice 1

Keep doing what you’re doing. Hope that somehow, magically, your financial stress will resolve itself. Continue feeling anxious about money, avoiding financial conversations, and wondering where your hard-earned income disappears to each month.

Choice 2

Take one simple step toward the financial peace you deserve. Schedule a free, no-pressure conversation where we’ll talk honestly about where you are and where you want to be.

Which choice gives you a better chance of sleeping peacefully a year from now?

Roberts Hayes

Ramsey Preferred Financial Coach

Mon – Thu : 9:00 AM – 9:00 PM EST.

Sat : Closed

Sun : Available upon request